“Zetachain is essentially THORChain with smart contracts. The ability to deploy omnichain protocols is the key selling point for the network. There is a large opportunity to become the hub for cross-chain applications, provided that ecosystem building moves in the right direction.”

Top 3 Key Takeaways

- Zetachain is building a bridge into a smart contract platform in a bid to create a platform for omnichain smart contracts.

- Omnichain smart contracts enable applications to live on multiple chains but still be connected and share liquidity.

- There is opportunity for Zetachain to seize across DeFi, NFTs, and Ordinals. Whether this will happen comes down to strategy execution and ecosystem building.

Key Takeaways

- Zetachain is a PoS blockchain built with the Cosmos SDK and CometBFT consensus. It can be simply described as “THORChain with smart contracts” or “Axelar with the EVM on it”. Zetachain’s bridging module supports cross-chain message passing, which enables omnichain smart contracts.

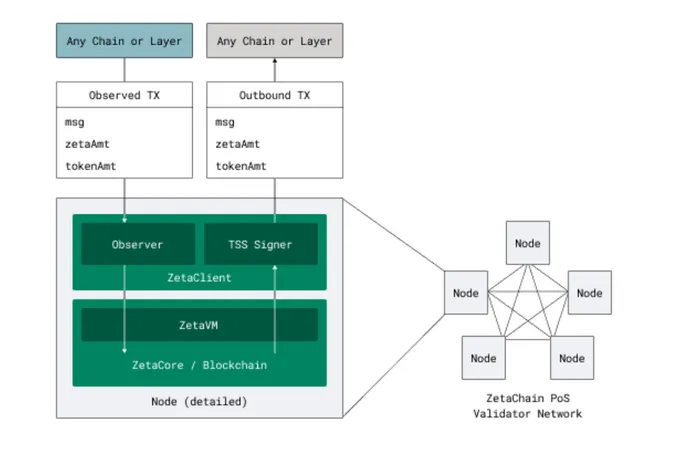

- The high-level architecture of the network involves nodes running two software programs: ZetaCore and ZetaClient. ZetaCore is responsible for producing blocks on the network, similar to any other PoS blockchain. ZetaClient is responsible for cross-chain actions such as observing and signing events/transactions.

- The network participants responsible for cross-chain functions are called “observers”. These participants run a full node for every external chain that Zetachain supports bridging for. Observers are split into two roles: sequencers and verifiers. Sequencers listen to and send events from an external chain; verifiers vote and come to consensus on the events or changes.

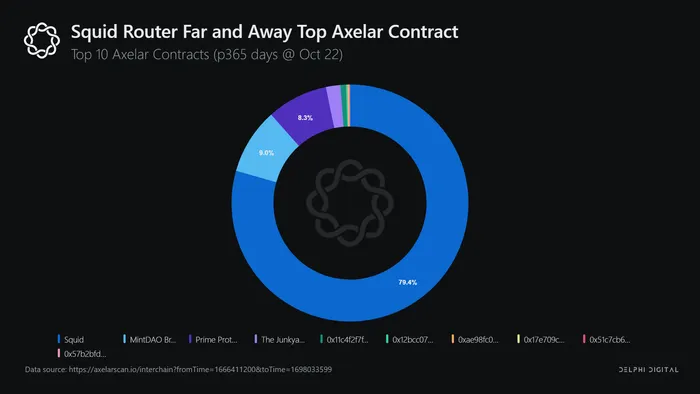

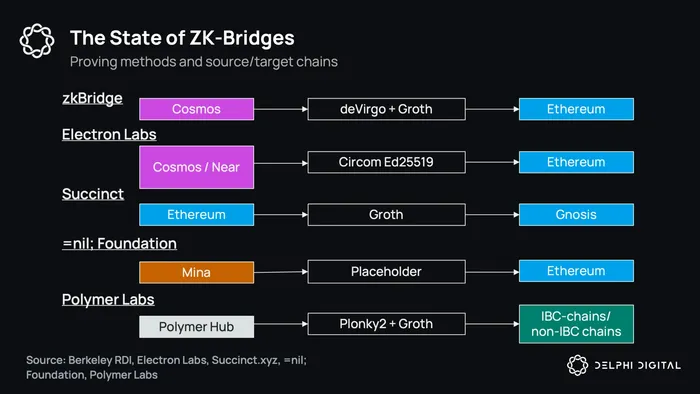

- Zetachain has a fairly long list of existing competitors that do more than just bridge tokens between chains. The closest competitors are Layer Zero and Axelar.

- LayerZero supports cross-chain messaging passing, which has been used to power Radiant Capital – an omnichain money market. Axelar also supports cross-chain messaging but also supports smart contacts via its native virtual machine, AVM (WASM). However, Zetachain likely has the upper hand in this domain as they have co-opted the most popular virtual machine, the Ethereum Virtual Machine (EVM).

- IBC, pioneered by Cosmos, is a bridging standard that also technically competes with Zetachain. While IBC is considered close to the gold standard in bridging, Zetachain still wins in certain aspects. For example, IBC is mainly used between Cosmos SDK chains today. Zetachain’s architecture and EVM-compatability means bridging to and fro Ethereum-centric chains is simple, and applications on EVM chains can run on Zetachain.

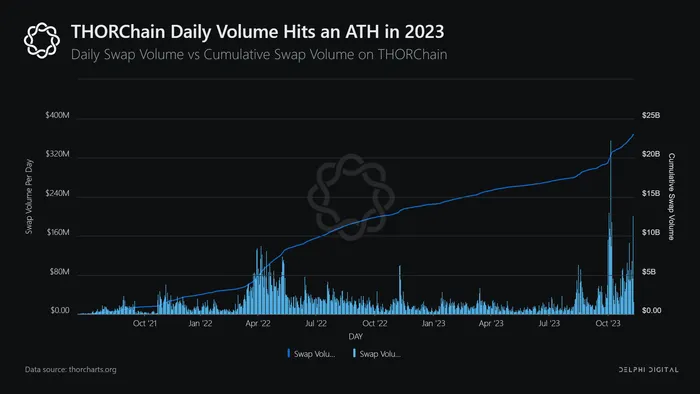

- THORChain is the closest thing to Zetachain in terms of architecture, excluding smart contracts. While THORChain aims to be a DEX/bridge specific app-chain with enshrined features, Zetachain can possibly become the home to a barrage of applications and more app-layer innovation.

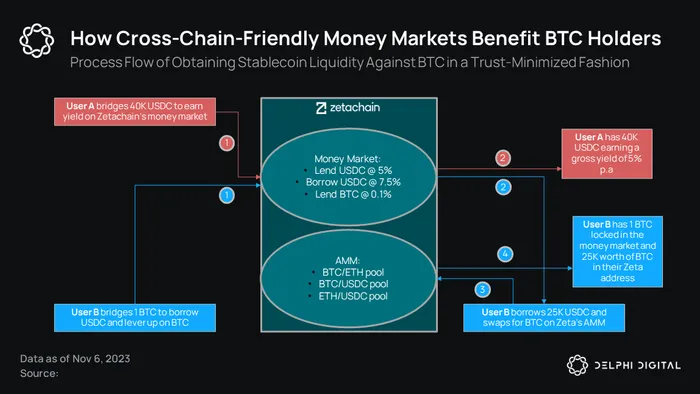

- On the application layer, the main areas we believe Zetachain should focus on include: omnichain DEXs, yield opportunities, truly omnichain money markets, consumer aggregation apps, and general purpose cross-chain P2P infra.

- The gist of the opportunity here is in allowing, say, a DEX to have instances on various chains that are connected to each and share liquidity – as opposed to the status quo, where each DEX deployment on a new chain has siloed liquidity.

- Consumer aggregation apps can be thought of as a global hub for multi-chain derivatives liquidity. Imagine being able to sit on a single platform and have derivatives trades split up between the various derivatives DEXs that sit on different chains.

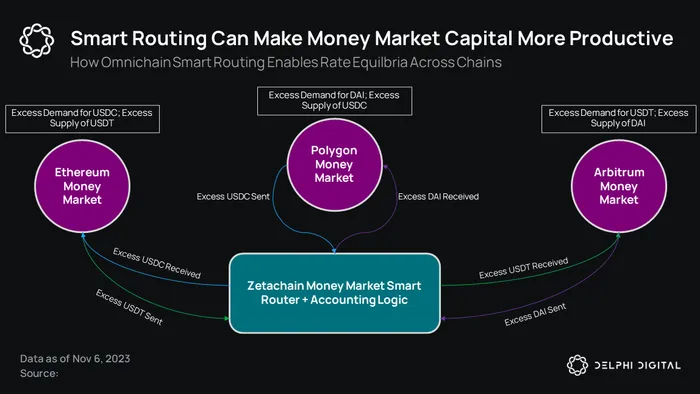

- Omnichain money markets can improve liquidity efficiency by several orders of magnitude. If there was demand to borrow an asset on 3 different chains, but the supply was mostly in the money market’s deployment on a different chain, supply could be efficiently routed to where demand is, benefiting lenders and borrowers.

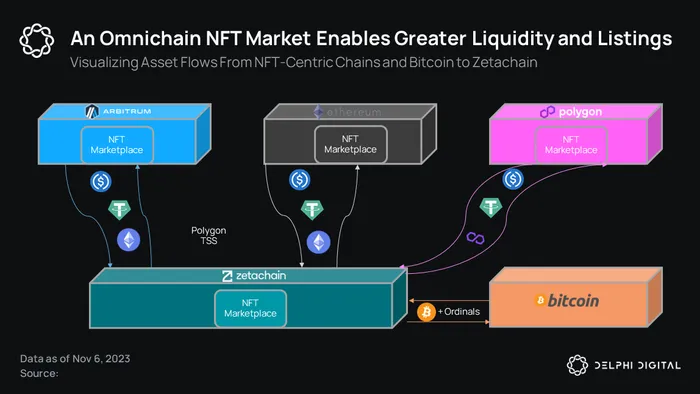

- Given Zetachain is able to bridge from and to Bitcoin, there is an opportunity to build Bitcoin-friendly DeFi in the way THORChain has. Ordinals are also a massive area of opportunity, given recent activity.

- Furthermore, the UX of interacting with Ordinals is still clunky owing to Bitcoin’s simplicity. Zetachain could serve as the infrastructure that powers a sharp user experience in the Ordinals ecosystem.

Additional Charts & Analysis