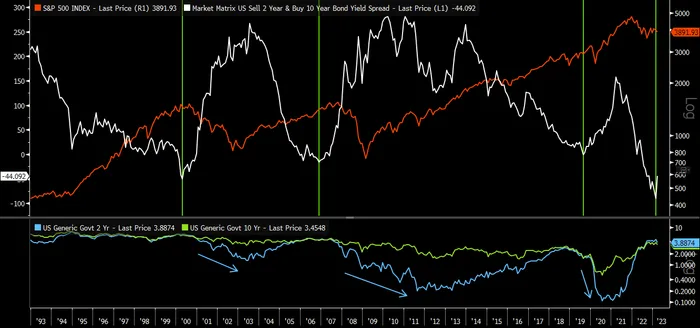

The historic drop in US 2-year Treasury yields has many cheering for a Fed pivot, but be careful what you ask for.

To pull a quote from our Markets Year Ahead report, “equities tend to suffer painful drawdowns when the yield curve starts to re-steepen, as that’s when the market starts pricing in lower rates in response to weakening economic conditions. History shows that equities can perform quite poorly in the immediate aftermath of a Fed pivot.”

Moves of this magnitude at the short-end of the yield curve send a more cautionary tale. We did see near record speculative short positioning on Treasuries heading into this week, which has certainly exacerbated some of the volatility in bond markets.

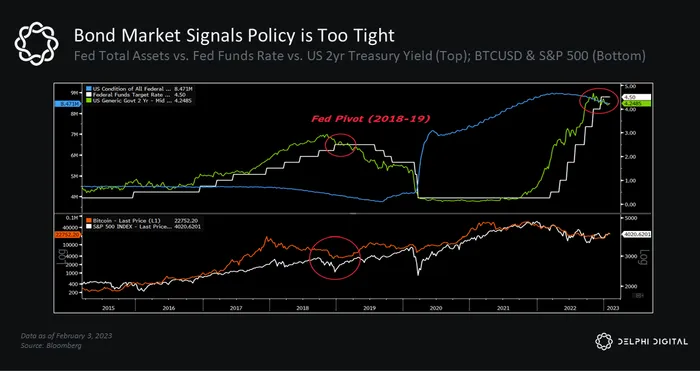

But as we noted several weeks ago, the bond market was already starting to signal that policy was too tight.

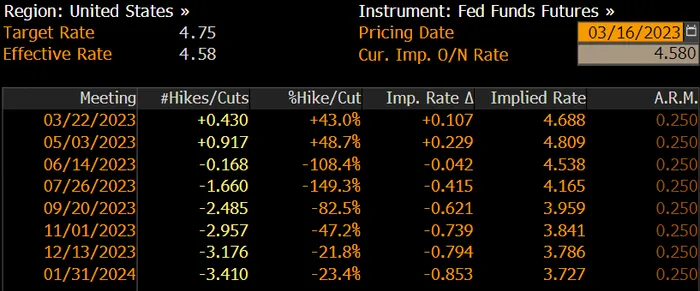

Uncertainty over additional fallout in the banking sector has also caused a huge repricing in fed fund futures. The market is now pricing in a ~40% chance of a 25bps hike at next week’s FOMC meeting, a stark contrast to the ~70% odds of a 50bps increase just a week ago.

Uncertainty over additional fallout in the banking sector has also caused a huge repricing in fed fund futures. The market is now pricing in a ~40% chance of a 25bps hike at next week’s FOMC meeting, a stark contrast to the ~70% odds of a 50bps increase just a week ago.

More telling is the repricing further out the curve. This time last week the market was pricing for an additional 100bps of hikes before topping out in September – now the story’s completely flipped with futures pricing in ~80bps worth of rate cuts by EOY.

Although much has changed the last few days, the Fed will try their best to stay the course next week. If they do decide to leave rates unchanged, it would send a damning signal that things really are getting ugly, which could spark even more panic (though they may not have much of a choice).

On the other hand, the Fed is looking for a silver bullet in its war against inflation, and few things can stop an economy in its tracks like the threat of a banking crisis.

But regardless of whether they raise rates or not, they’re going to lean heavily on their commitment to “address any liquidity pressures that may arise”, putting the higher rates + “shadow QE” scenario in play, a potential path we’ve discussed in the past.

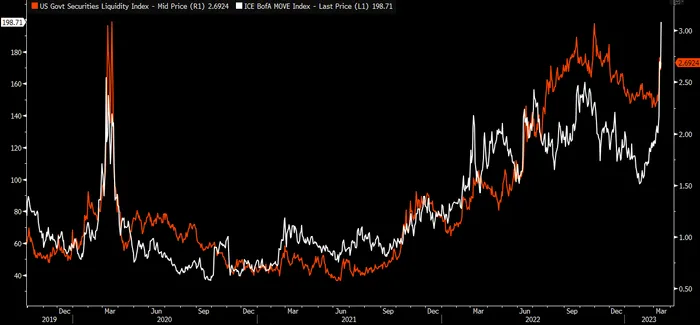

Fed officials will also be watching the charts and taking cues from the market. Financial conditions have tightened considerably the last few days and volatility is wreaking havoc on liquidity conditions, most notably in the Treasury market (something we’ve also had our eye on).

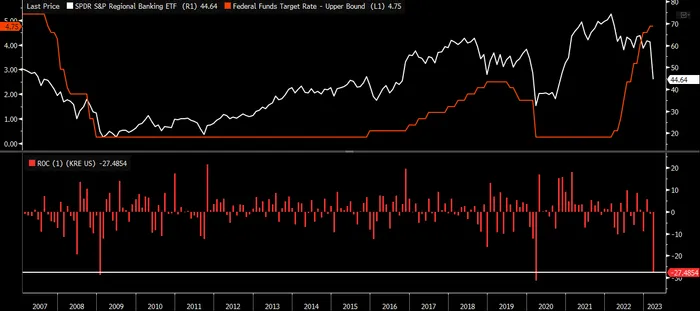

US Regional Bank stocks are on pace for their worst monthly decline since March 2020, echoing drawdowns we last saw back in January 2009. Every stock in the S&P 500 Bank Index is down at least 10% since the start of last week.

If bank stocks continue to tumble, it would force Fed officials to rethink their commitment to “higher for longer.”

If bank stocks continue to tumble, it would force Fed officials to rethink their commitment to “higher for longer.”

Markets tell stories and there’s nothing inspiring about flailing bank stocks when you’re trying to shore up confidence in the US financial system.