BTC has flipped back into a MIXED regime following a 33-day Cooperation stretch, signaling a transition phase rather than a confirmed trend continuation. Historical regime behavior suggests markets typically require a sustained 20+ day return to Cooperation before durable bases form. Technical confluence from Elliott Wave structure, Fibonacci clustering, and the 1W 200 EMA near $65-70k supports a continued consolidation and potential final downside probe before a relief rally. Near-term patience remains warranted, though longer-term BTC remains structurally attractive.

BTC GT model flipped back to MIXED, now on Day 2

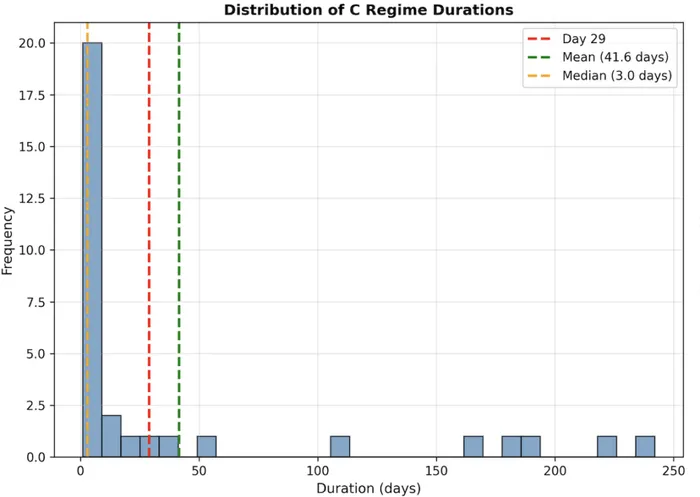

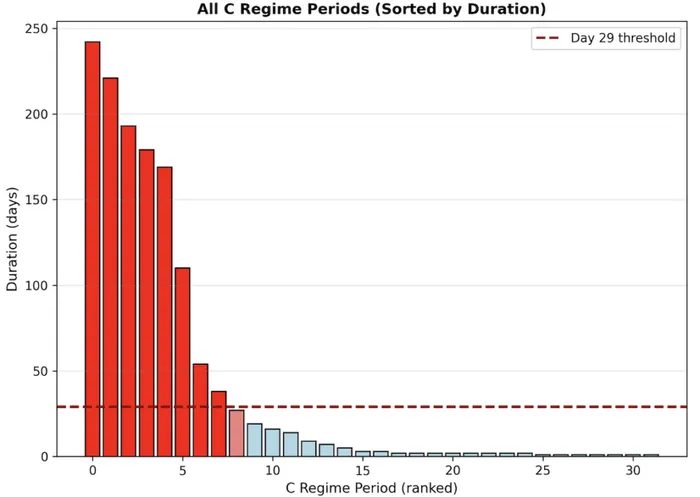

Important context: the prior Cooperation regime had already extended to Day 33 before rolling over. That said, MIXED remains a no-trade zone. After a long Cooperation stretch, regime transitions tend to be especially noisy, with higher whipsaw risk. I still want to see a clean re-engagement into Cooperation before taking on risk again.

Historically, new Cooperation regimes only become durable once they persist beyond ~Day 20. Until then, probabilities favor chop over trend and we are back in that reset phase now.

Recall that most C regimes need to cross the 20 Day mark for the regime to persist into a long term one. And C regimes based on my backtests have historically been the ones where bases get formed first before a larger push to the upside. Therefore I believe we have longer to go in this consolidation process.

My mental model is this: we first need to get away from Mixed / Defection regimes, make a push to Cooperation, and then sustain Cooperation before we can start talking about bases being formed.

From a Technical Perspective

From a price perspective, this continues to argue for consolidation. A retest of the 1W 200 EMA near ~$68k remains likely, with downside extension dependent on the quality of the reaction there.

Several fib pulls from a swing lows to highs shows a cluster of important fibs (0.5 / 0.618 / 0.786) all grouped around the 65-70k region as well, roughly around the 1W 200ema.

Revisiting my AF post “BTC Technical Snapshot – Elliott Wave Scenarios + Key Levels“, we did hit the 0.5 fib ~99k pretty much on the dot for our Bearish Path that I laid out.

We are now currently working on the 5th impulse wave down in this 5 wave structure to complete the larger drawdown before a ABC corrective wave up, which should coincide with a greater relief rally. However, if I have to align this view with my BTC Game Theory framework, unless the regime flips back to Cooperation and starts putting in a longer base (minimum 20 days+) i think the next rally should result in a lower high before grinding down and retesting the lows again

Closing Summary

Taking everything into view right now, it does seem that BTC needs to spend some more time consolidating at these levels before putting in a real reversal. I do believe that we are closer to a local bottom being in for now before a relief rally based on TA/sentiment/market structure.

At this current time, the next bounce should come in the form of a relief rally and I will do a deeper dive in my next AF on how this relief rally could take shape using EWT. But personally for now, I do not think there is a need to rush into any positions at least in the short term. Longer term though, I still believe BTC to be attractive at these levels.