Two days ago on August 15, I wrote a short activity feed post cautioning readers in the short to medium term due to what I was referring to as Crypto Price Action Apathy.

The goal of this post was to outline a framework for which we can use to gauge overall market health, taking into account things like:

- Overall volatility levels

- All-coin open interest levels

- Open interest dominance by coins

- Spot trading volumes

- Trading volume dominance by coins

Based on all of the above metrics in conjunction with one another, we were able to determine that while the longer term outlook for crypto markets appears to be very bright, the shorter term outlook remained more ominous. We combined the above metrics with some added context around how BTC was trading.

More specifically, with all of the positive catalysts giving BTC an immediate boost, price action was unable to sustain momentum into the key regions $30K-$32K. We concluded that many of the signs we were seeing were indicative of exhaustion and poorly positioned market participants, a thus “short to medium term caution still very much being warranted.”

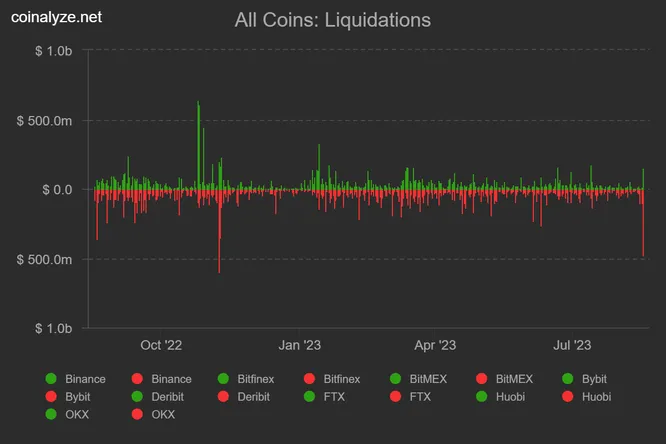

Since this post (and previous ones), price action and morale have not improved. Instead, this afternoon prices have absolutely nuked into key levels around $25K, from ~$28K in a few short minutes. Liquidation events like these never fail to get the blood pumping.

The carnage? Our largest liquidation event in about a year (since FTX). Price have begun to recover a bit from the violence. As with most liquidation events, the aftermath is prime for reversion trades due to the empty order book and dynamics at play. You can read about this topic in our report, Liquidity Cascades & the Evolution of Financial Markets.

Hopefully this framework of thinking has served its purpose spreading the word of caution leading into this dump.