In our report titled “Do Fundamentals Matter in Crypto Markets?” we introduced the importance of weighing in token incentives while analyzing a protocol’s revenue. This is crucial as it helps sift through incentivized revenue and get a clearer picture of actual traction/usage if the incentives were removed from the equation.

Now, with that in mind, can we use our understanding to find inefficiencies in the valuations of comparable protocols? Let’s find out.

The recent flurry of short squeezes has presented some immense opportunities for the astute. There are many, but let’s focus on one at a time.

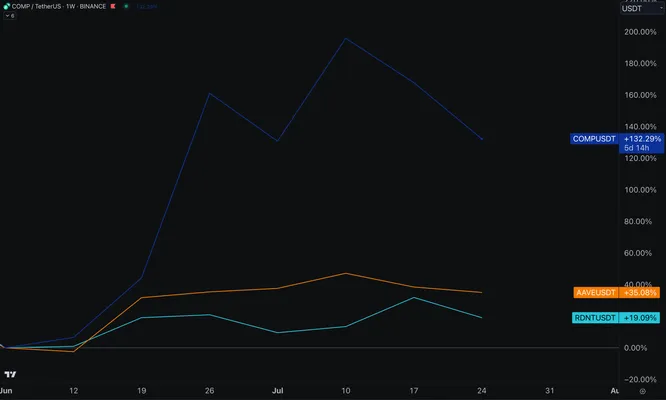

Compound has been on an absolute tear since early June, gaining a whopping 270% from low to high. It briefly broke below its weekly range lows but quickly reclaimed and managed to break above its range highs. The same region is being retested as support at the moment.

But has anything changed fundamentally? Not quite sure. Just look at its adjusted revenue over the last 180D, sitting at -$7.36M.

In comparison, AAVE and RDNT have managed a much more modest return in the same time period.

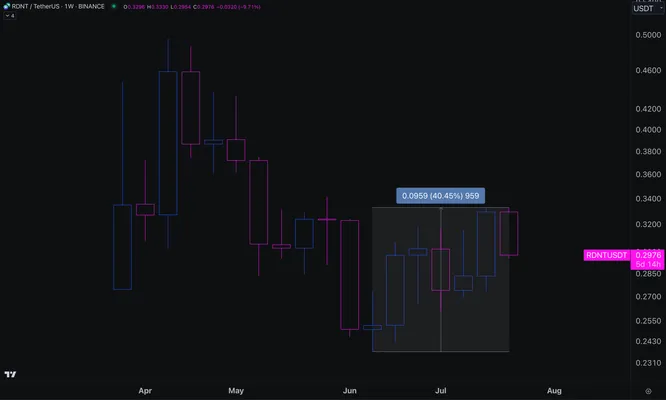

Unsurprisingly, AAVE bounced off its range lows but has barely managed to make it to the range highs, rallying about 86%. Whereas RDNT sports even more muted returns of around 41%.

In terms of their adjusted revenue, both flaunt much more impressive numbers, with AAVE at $4.5M and Radiant at $4.8M.

For context, the circulating market cap of Aave is $1B, Compound is at $416M, and Radiant is at $86M.

So, when we add everything up, the valuation mismatch becomes much more apparent, and it shouldn’t surprise anyone if the market has repriced these assets in the near future, i.e., AAVE and RDNT outperforming COMP by a considerable margin.