Much has been made of the BTC narrative year to date, and rightly so. We have seen BTC benefit from the Ordinal/BRC20 innovations earlier this year. We have seen BTC benefit from the outside money narrative as it pertains to the banking crisis. And we have seen BTC benefit from the spot ETF applications from many of the largest US money managers. This has left many asking, ‘wen ETH’s turn?’

Those days may finally be approaching, and for numerous reasons.

- EIP 4844 – the next Ethereum development upgrade/roadmap milestone slated for Q4 2023

- ETH ETF narrative begins as BTC ETF approval odds increase

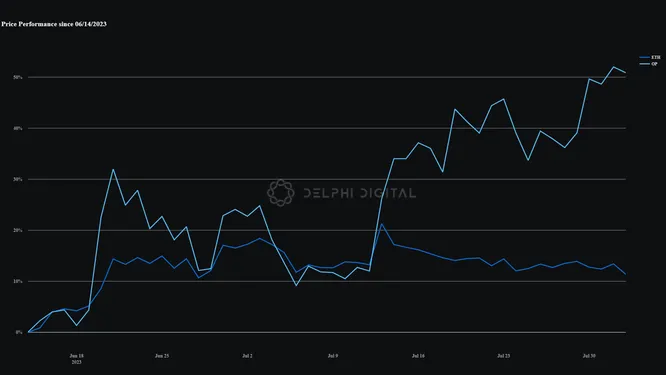

However, when looking at ETH price performance since the lows caused by SEC enforcement action against Coinbase and Binance in June 2023, it has been less than stellar.

Remember, higher beta assets are often chosen vehicles of speculation when looking to capture movements on larger assets like BTC or ETH. Out of the lows, we have seen assets like OP outperform ETH significantly.

This relative strength is intriguing, especially when taking into account the prior reasons for why ETH based narratives may catch a bid. Additionally, Coinbase has set the official launch of the Coinbase L2, Base, for next week.

We mentioned this ‘proxy-bid’ dynamic on OP/ETH in last month’s report, Catalysts Stacking Up – Will Narratives Drive Fundamentals. We expect this dynamic to persist, and will continue following it over the next several weeks.