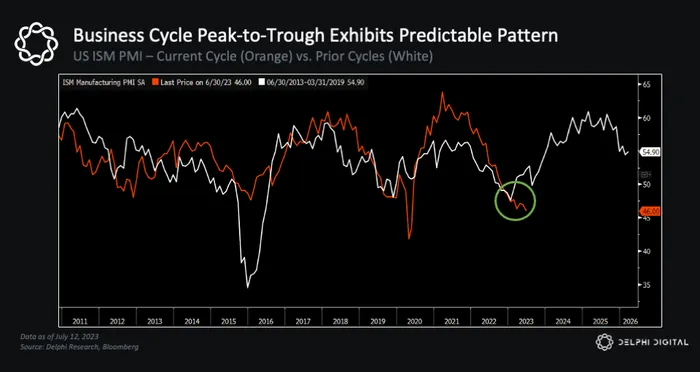

We’ve talked a lot about where we think we are in this cycle, but I want to highlight one of my favorite charts at the moment.

I won’t rehash why the ISM is important – or why it’s one of the best indicators for forecasting trends in asset prices – but rather point to another reason why we think the ISM is nearing the end of its two-year downtrend.

As we discussed in our latest Markets deep dive report, it’s crazy how closely the ISM has tracked the trajectory of prior cycles, including the timing of its peaks and troughs. Every ~3.5 years, it’s rinse and repeat, like clockwork.

The consistency of these macro cycles is one of the reasons why BTC has followed a similar path as its prior cycles. We highlighted this in our Markets Year Ahead report back in December – and once again, BTC started to recover right on cue.

This is also one of the reasons we see similar cyclical price action around Bitcoin halvings, which also happen to occur roughly every four years.

This is also one of the reasons we see similar cyclical price action around Bitcoin halvings, which also happen to occur roughly every four years.

This is just a snippet from our latest Markets deep dive report, ” Catalysts Stacking Up – Will Narratives Drive Fundamentals?”, where we provide an update on a few important “heavyweight narratives” (that actually impact price), where we may be in the cycle now, and some of the key catalysts that appear to be setting up a more favorable year ahead.

We also examine several “lightweight narratives” that may be poised to thrive once the burden of their heavyweight counterparts dissipates.

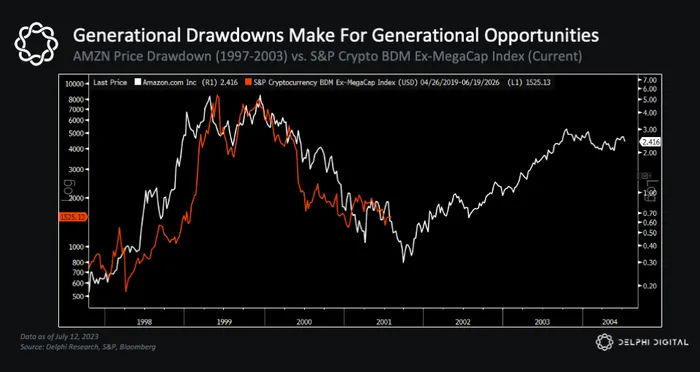

They say good things come to those who wait – just ask anyone who had the stomach to stick with AMZN in 2001…