Lyra has been at the forefront of options innovation for years now. Lyra v2 is now rolling out on Lyra Chain and the data so far is impressive. Lyra and Aevo’s recent growth suggest DeFi options have finally reached a turning point in competing with CEXs. After generating nearly $150M options volume in Jan, it’s hard to not be intrigued by Lyra right now.

There are several bullish catalysts for Lyra:

-

New upgrade with significant improvements

-

Increased traction by an order of magnitude at an early stage

-

A revamped governance token with a path to value accrual

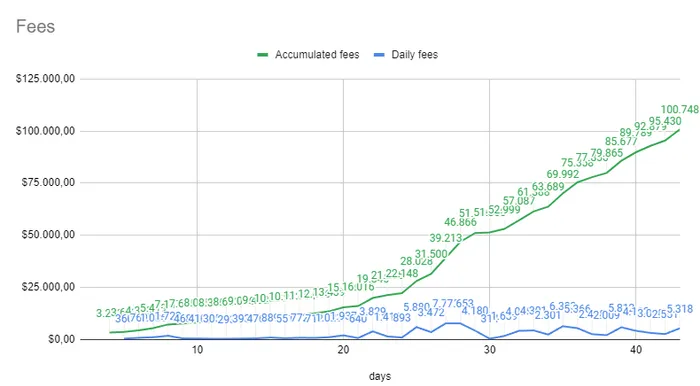

Source: AlvaroHK

In the past, options protocols couldn’t compete with CEXs on spreads, leaving little room for the protocol to charge fees, let alone distribute fees to token holders. Lyra v2 earned $100K in fees during first 43 days of launch.

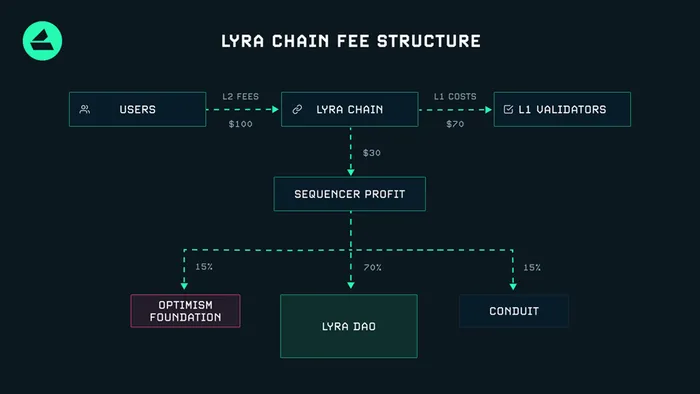

The options rollapp model being pioneered by Lyra and Aevo offers viable path to value accrual for the first time. For the time being, fees are accruing to the safety module. A governance proposal detailing new LYRA tokenomics should be released soon.

Lyra’s valuation ($91M/$120M) is already at the top of options sector, despite all of them – Rysk, Dopex ($22M/$39M), Premia ($14M/$38M), and Hegic (29M) floundering throughout 2023. Ribbon/Aevo ($410M/$457M) is priced much higher, but is often comped to dYdX rather than the options sector. In terms of volume, Lyra has distanced itself from the smaller players even more than before. It is clear the options sector is due for a repricing, but is in need of a catalyst.

With LYRA price action sideways over the past few months, it may present a strong opportunity. LYRA is objectively more attractive now than it was several months ago and the market appears to be lagging. Lyra’s new incentive program is an important wrinkle to consider.

Lyra just launched an ambitious liquidity mining campaign that will distribute 150M LYRA over 96 weeks to Lyra Chain users, with the steepest emissions coming at the end of launch season.

The good news here is these LYRA rewards are the among the last of LYRA token emissions. The 150M LYRA will bring circulating supply from 765M/1B to 915M/1B, making the LYRA token almost fully diluted. The incentive program will make up 15% of total supply, which equates to roughly 20% of the current circulating supply. This is far more ideal than when newly launched tokens have an incentive program in which 15% of the total supply might double the current float.

Given the expanded scope of the LYRA token, the manageable impact of the incentive program on the circulating supply, and the already impressive organic volume, a successful incentive program could spark a strong options narrative.