Last time we covered Ostium was in our Year Ahead reports. First time was in July 2024 when it was still on testnet. Much has happened since then.

Total volume traded exceeds $39.4B. Total fees sit at over $18.5m. Gold (XAU/USD) is the most traded perp by volume. Daily users and OI are up and to the right. Annualized fees (over past week) hover around $50m.

Ostium initially had my attention because the team deliberately chose to sidestep a CLOB model. What started with a dual LP structure is evolving into an RFQ system with a tangible moat. Execution and liquidity are unmatched. 5bps spread on an $18m trade? Not possible anywhere else onchain.

18M trade. One shot. 5 bps spread.

The most liquid place to trade RWAs on chain. pic.twitter.com/tAw1UsZZ7m— marcoantonio.eth (@contrarianmarco) February 3, 2026

I believe Points Season 2 will be the last and final season. If you’ve been paying attention, this will be a massive airdrop for you. And it’s not too late to snag some shiny points, either.

But before we get into the nitty gritty and extrapolate what one Ostium point (OP) might be worth, let’s start with some facts.

Ostium last raised over $20m (Dec 2025) at a valuation of $250m. That’s important because TGE’ing at this FDV would be my bear case.

Points distribution is quite straightforward as well:

- Pre-Season: 10m (ended)

- Season 1: 21m (ended)

- Season 2: 25m (ongoing)

The Napkin Math

Season 2 is in week 6. So far, looks like ~5m points have been distributed. With a hardcap of 25m points → 20m are yet to be streamed to LPs and traders.

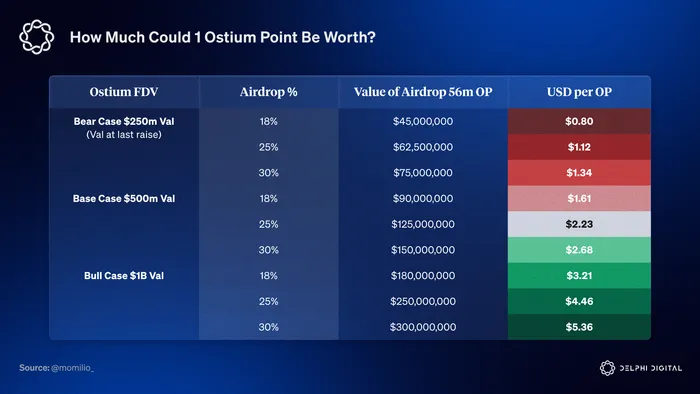

If this is indeed the final season, total points will peak at 56m. That leaves us with two variables left to define: airdrop size & FDV at TGE.

Hyperliquid airdropped 31% of its total token supply at TGE. Lighter airdropped 25%.

I’ve been pestering the Ostium team since testnet and would say I have a good gauge on them. They are as crypto native as it gets, and over the last two years, continued to make the right decisions.

Ostium today feels totally different (and way better) than it did a year or even three months ago. Fast product iterations are the best indicator that a team cares about community feedback.

I’d be very surprised if they turn out to be stingy and botch the airdrop. From talking to the team, it seems like they will model after HL and Lighter. Big assumption, no promises.

All that to say, my belief is they will airdrop anywhere between 18% to 30% of the total token supply. In my view, a percentage in the 20s is more likely, high 20s less likely. They do have external investors after all. To simplify, we’ll calculate across 18%, 25%, and 30% of total token supply.

I’ll spare you the tradfi calculation around valuation multiples because these are a) boring, and b) worthless when applied to crypto apps.

Some reasonable high level valuations are easy to derive:

- Scenario A: Bear Case – $250m Val

Ostium’s growth stalls/ declines. They fail to build out their RFQ model and competitors catch up on execution quality. TGE happens at $250m FDV, same val as last raise.

- Scenario B: Base Case – $500m Val

Growth continues, albeit at a slower pace. The whole Equity / Perp market pie fails to expand sizably this year. Hype and demand for onchain stocks stop accelerating. Ostium grows annualized revenue north of $100m but overall market growth rate is bleak.

- Scenario C: Bull Case – $1B Val

Growth rate continues, entire RWA perp pie expands, and Ostium grabs more market share from competitors. Annualized fees grow meaningfully.

Single then multiple RFQ is implemented successfully. Product moat is maintained and the new design improves capital efficiency + margin requirements.

Distribution and marketing finally get the love they deserve. Traders on traditional brokers are poached and retail outside of crypto starts using Ostium. Ostium scales rapidly and captures a bigger market share. Their lofty target of $500m in annualized fees is hit (atp $1B FDV would be a joke).

I’m gonna stop here. Average monthly CFD volumes exceed $30 trillion, a massive market to target where brokers are as scammy and opaque as it gets. If Ostium can convey the upsides of trading on its platform and onboard this cohort, the bull case is strongly understated.

But let’s keep it conservative, we’re in a bear market. Not yet time to be a bulltard.

Putting it all together, we get the glorious sheet of cope for the sidelined:

To reiterate, Season 2 is hardcapped at 25m OP. Roughly 20m points are left to be streamed to the public.

This gives us around 20 more weeks to farm as many points as possible.

Depending on macro news, Ostium boosts certain pairs each week. Low-hanging fruit to trade these to maximize your points allo. Deploying capital in the vault also earns points for those preferring the passive route.

I’ve been doing a combination of both each week, my soul yearns for more OP.

Easy 6 fig airdrop for anyone paying attention.

Disclaimer: I have Ostium points and am actively farming.