There’s an emerging narrative quietly proliferating in DeFi.

Coined by the President of Solana Foundation, Lily Liu, PayFi is the idea that stablecoins can meaningfully lower the cost of capital for businesses who rely on short-term financing. In other words, by harnessing both the instant settlement times and lower barriers to entry that crypto rails offer, PayFi more efficiently matches liquidity suppliers and businesses who need short-term financing.

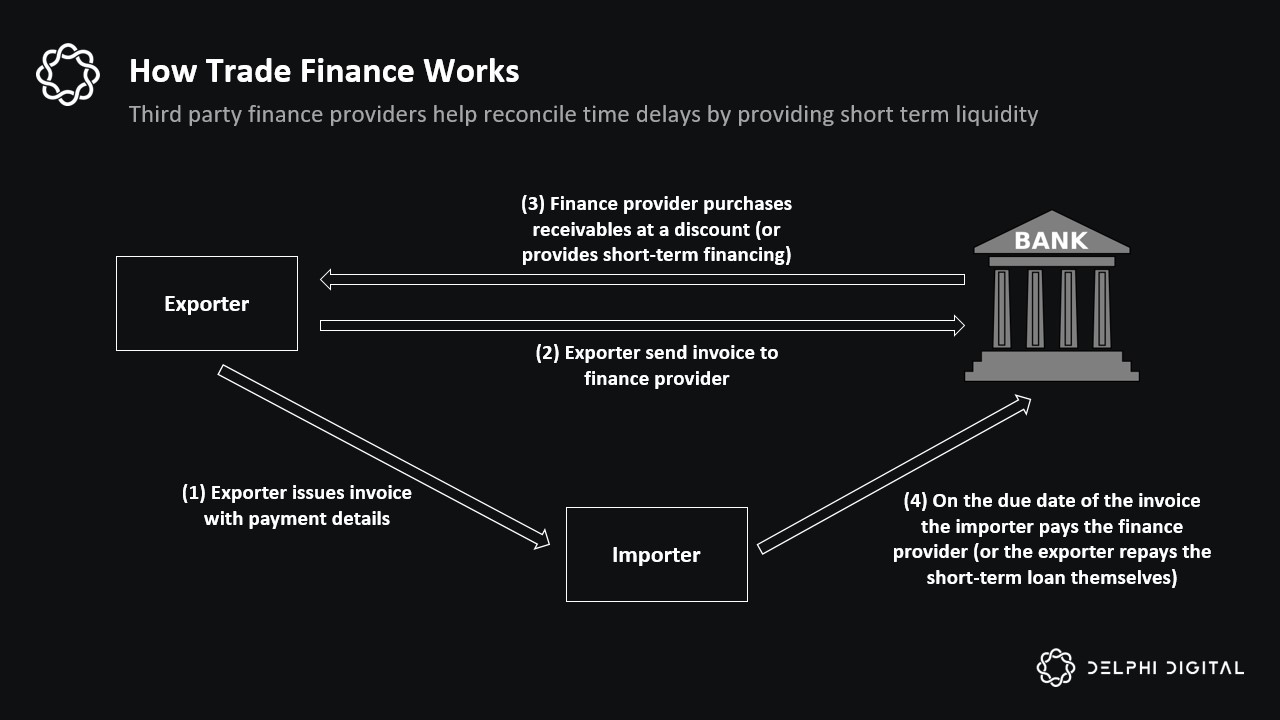

While this may seem like a trivial unlock, financing plays an essential role lubricating the cogs of our global economy. The ability to access and invest $1 today to generate more than $1 in the future is deeply fundamental to how global business operates at scale. This is often referred to as the time value of money. To better conceptualize things, let’s look at an example.

Imagine you run an oil company that exports oil from of the Middle East to the United States. Importantly, when you export this oil, there is a delay between when the you ship the oil and the importer receives the oil (transit times by sea can be upwards of 30-45 days). Intuitively, as soon as you ship the oil, you want that money up front so you can fund your next extraction/production cycle and cover general operating expenses. Your “time value” of money is important to you. However, the importer is unwilling to pay you up front given they haven’t received the oil yet.

To reconcile these competing incentives, there are two primary solutions today. The first

...