As discussed in “Avoiding the Real Banking Iceberg”, one of the biggest downstream headwinds to the banking fallout is a material slowdown in credit growth and tighter financial conditions.

Debt is the backbone of our economy, which means any disruptions to the flow of credit are disruptions to economic growth. When credit conditions tighten, it can have substantial ripple effects on everything from businesses to jobs to consumers to investors. If the US economy is an engine, credit is the oil. Without it, the car won’t run.

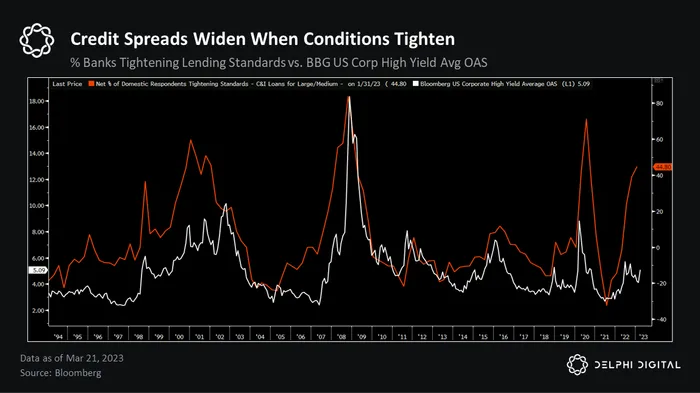

Credit spreads will widen further if credit conditions tighten considerably. Banks had already started tightening lending standards even before the recent panic.

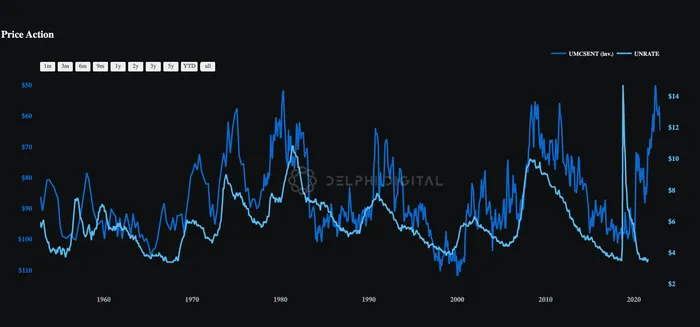

And tighter financial conditions usually leads to higher unemployment.

US consumer sentiment fell to record lows as inflation jacked up prices on everything from eggs to household energy costs. Similar drops in consumer sentiment, historically, have led a rise in unemployment (lagged 18 months in the below chart).

Consumer sentiment has started to improve the last few months, but the latest concerns surrounding the banking sector has to only added to heightened uncertainty.

Strong demand is key if inflation is to remain “sticky”, especially as some of the major supply-side headwinds start to abate. Supplier Delivery Times, for example, have improved and are expected to fall considerably over the next 6 months.

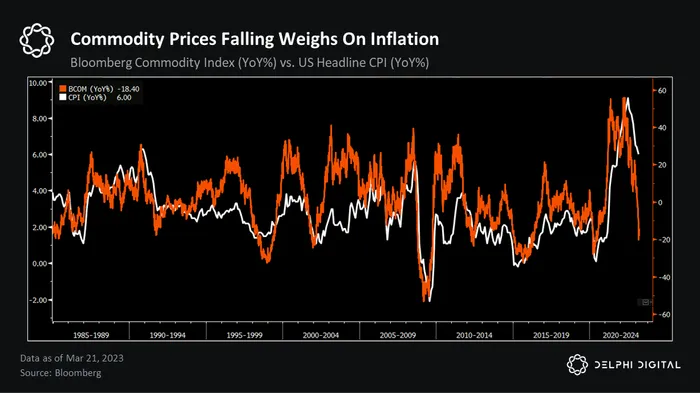

Commodity prices are also down year-over-year, which historically has a strong correlation with headline CPI.

Commodity prices are also down year-over-year, which historically has a strong correlation with headline CPI.

If lending activity slows and credit conditions tighten, it will drag on economic growth and, therefore, inflationary pressures. The Fed doesn’t have enough political cover to reverse course (yet) but there’s several arguments that favor more (rather than less) accommodative policy.

The longer the Fed holds steadfast in their current stance, the higher the risk that their hand will eventually be forced. History suggests policymakers are more reactive than proactive, even if it means playing chicken with the economy.