Synthetic margin trading encompasses protocols like GMX, Gains Network, MUX Network, and Mycelium. For the uninitiated, these are DEXs that import pricing from more liquid trading venues to facilitate a UX-friendly margin trading experience.

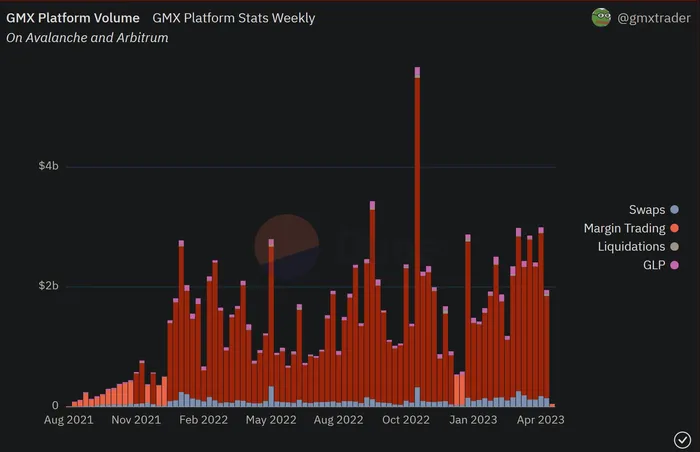

Source: Dune (@gmxtrader)

GMX and Gains have established themselves as products with proven market-fit. GMX routinely does over $2B of weekly volume.

Though GMX boasts spot swapping functionality, volume composition on the DEX shows us that the vast majority of volume comes from margin trading.

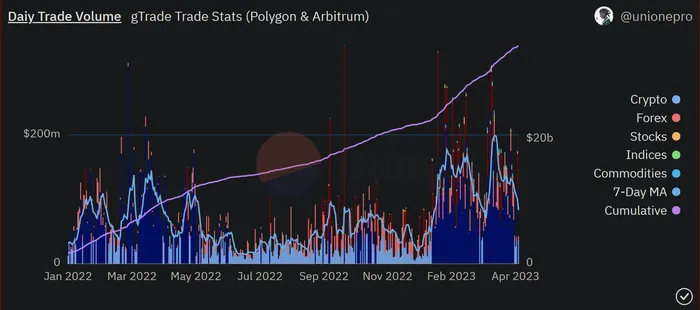

Source: Dune (@unionepro)

While Gains Network’s volume is lower than GMX (averages about $600-900M in weekly volume), the DEX has found strong adoption by choosing to compete differently. Gains has far more tradeable assets than GMX — a notable point of weakness in GMX’s current product offering (GMX v2 seeks to improve on this).

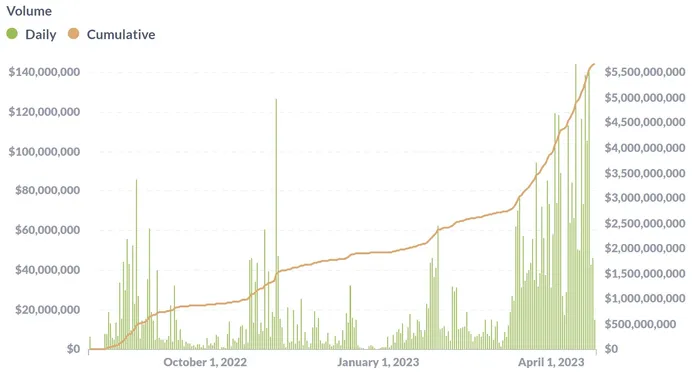

Source: MUX Dashboard

Yet another variant of this, MUX, is beginning to show signs of life with volume starting to trend significantly higher over the past month +.

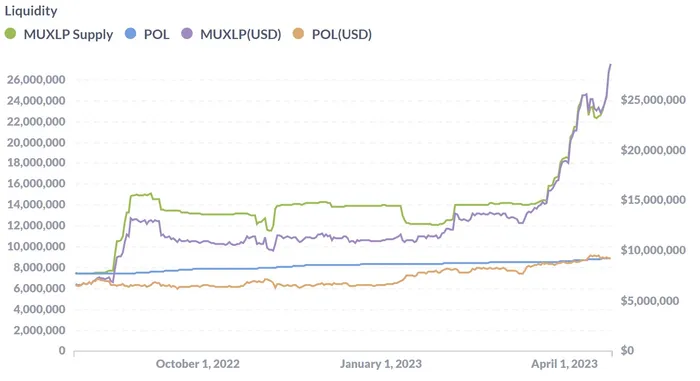

Source: MUX Dashboard

Liquidity paves the way for volume. And MUX’s liquidity is also trending upwards, though still far off from the likes of GMX and Gains.

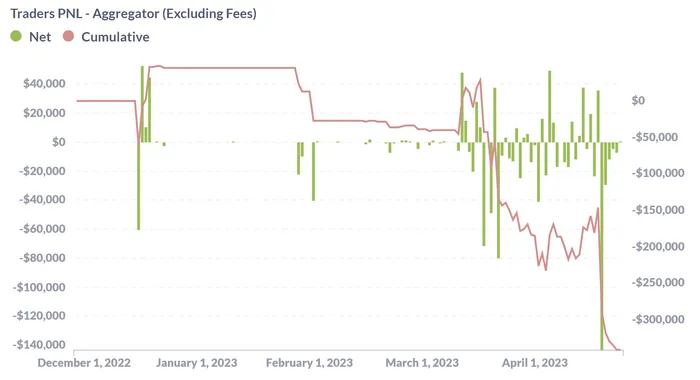

We’ve seen this playbook repeat a few times now. The way synthetic margin trading protocols and its LPs generate revenue largely comes down to one factor. LPing in these protocols or owning the token is a bet on the trader class losing on a net-net basis. And this is precisely the case for MUX too.

Source: MUX Dashboard

The evident growth in this vertical leads us to the conclusion that it is one of the more proven business models in DeFi with confirmed demand on the user side. The sheer number of copycats is yet another piece of info that directs us towards this same inference.

Perpetuals, while similar, have struggled with a myriad of problems on-chain. dYdX is a notable outlier, but its advantage with v3 is essentially a centralizing cheat-code to override current blockchain scalability limits.

Synthetic margin trading is DeFi’s current solution to bringing traders on-chain. It provides the perfect mix of UX for traders and a house-edge for LPs. Trader’s get the product they desire. Some win and some lose. LPs get to take the other side of all of these trades, which probabilistically bodes well for them. Token holders, depending on the specific protocol/token, also benefit from a piece of fees brought in.

Sounds like a rosy situation all around.