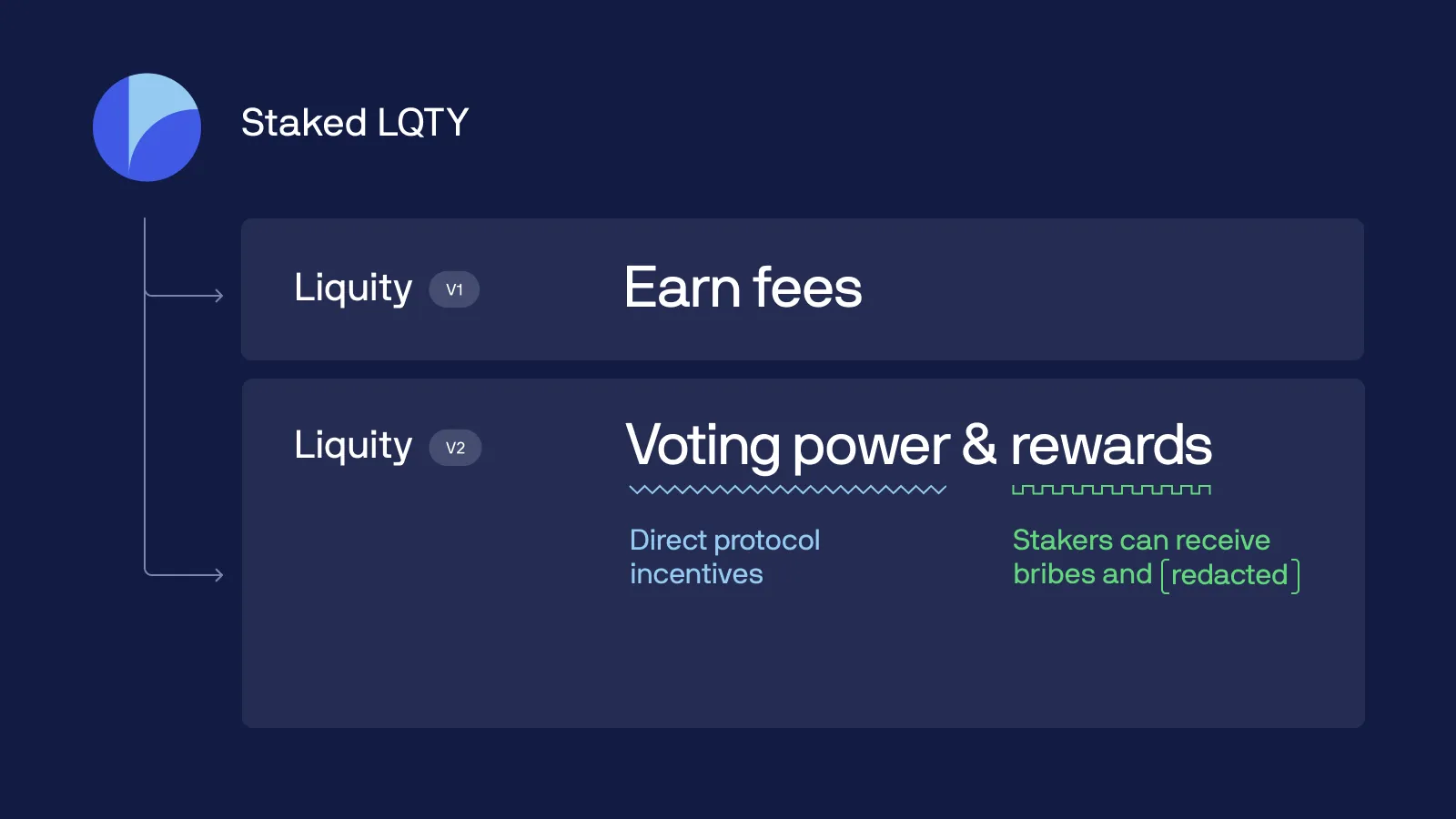

The Liquity v2 codebase was released today, along with details of LQTY’s role in v2. LQTY will power a Protocol Incentivized Liquidity (PIL) model, allowing LQTY stakers to direct subsidies made up of protocol revenue. Staked LQTY will retain the same roles and benefits of v1, in addition to its PIL role in v2.

We have previously discuss

...