Recent Research

📊 Bull vs. Bear – FOMC: Credibility Crisis – 5/3

- In Market Matters, we delve into the Fed’s credibility, exploring their capacity to maintain higher rates for longer and whether they’ll need to reactively cut rates swiftly if things start to break. In Bullish or Bearish, we touch on favorable third-year presidential term market trends and the looming US debt ceiling issue.

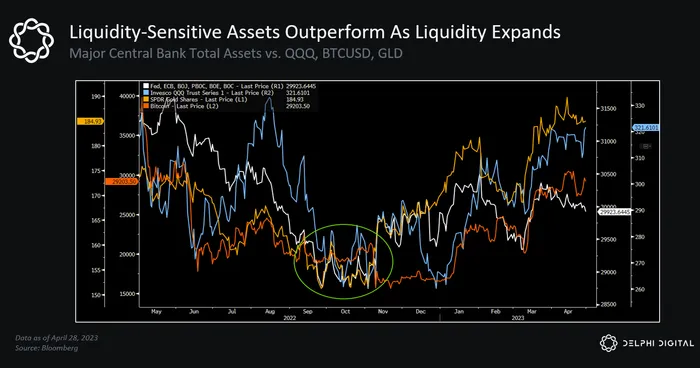

📊 Pulse Check on Liquidity Trends – 5/2

- The plateau in global liquidity growth has started to pare gains in liquidity-sensitive assets such as crypto and even gold.

- Bank lending activity tends to lag tighter lending standards and leading economic indicators like the ISM.

- Recession fears are back in the limelight too, but remember that the US cannot afford to suffer a real recession.

- We believe debt monetization is the most likely (and probably the only politically acceptable) path forward once these issues come to a head.

📊 April Gaming Roundup – 5/1

- Despite the broader crypto market performing quite well in April, with ETH making a run past $2,000, the Web3 gaming sector continued to follow a downward trend.

- Active gaming wallets fell to levels last seen in 2021.

- Ronin staking rewards went live, causing RON to pump.

- The gaming tech giant Razer announced the launch of its Web3 incubator/venture fund, zVentures (ZW3I).

- Square Enix has entered into a strategic partnership with Web3 distribution platform Elixir Games.

📊 Skip: Building Blocks in Cosmos – 4/27

- MEV touches nearly every on-chain transaction, and the goal of protocols is to identify and extract it as efficiently and fairly as possible.

- Those protocols who are not able to capture the MEV they create will struggle to accrue value.

- This is where Skip comes in, providing the infrastructure for Cosmos appchains to capture their MEV.

- The sovereign MEV thesis looks to address this shortcoming, taking the typical MEV supply chain one step further; why don’t we end with the protocol instead of the validator, and allow the protocol to “internalize” the MEV it creates?

Relevant Reminder

📌 The DeSocial Protocols – 4/24

- When you use a centralized social app, your social graph (the entirety of your experience on the platform) exists at the whims of those who control the platform.

- Nostr, Lens Protocol, and Farcaster are communication protocols rather than centralized apps.

- When the user ID and content are secured by credibly neutral protocols as opposed to clients/apps, the power structure shifts from clients/apps to users.

- DeSocial protocols are not replacing Twitter or Facebook. They are building open networks to host more equitable versions of those entities.

- Nostr has no on-chain component (except for Zaps), Farcaster uses Ethereum only as its identity layer (FIDs & FNames), and Lens puts the entire social graph on-chain via NFTs.