Voltz has had a difficult few months since our report back in May. After being live for over 12 months with no real issues, Voltz suffered two insolvencies that have derailed its momentum.

On the 21st of June, the GLP-ETH rate shot up from 10% to ~50% in one day, after trading consistently under 13% since May 9. The risk engine did not require traders and LPs to post an adequate amount of margin, resulting in an insolvency once the GLP rate shot up. Circuit breakers were triggered to minimize the damage, limiting the shortfall to 142.47 ETH (roughly 67% of the 210 ETH value of all marked to market positions).

The shortfall was covered by the project treasury, and the dormant fee switch was activated to build up a default fund for such instances moving forward.

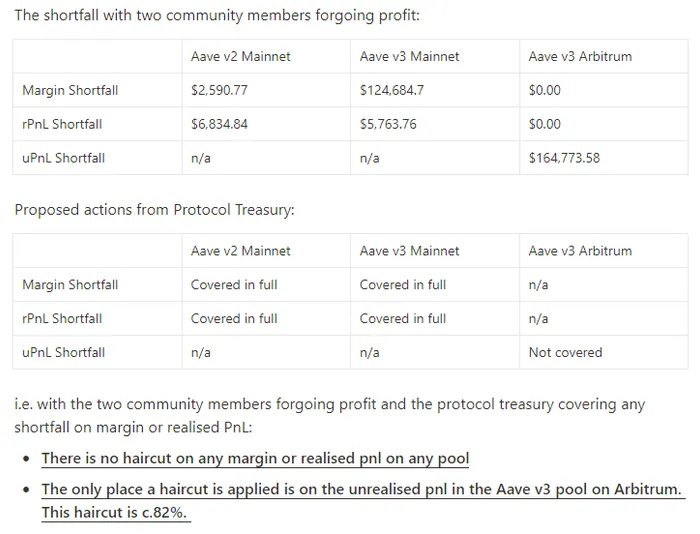

At the end of July, Voltz found itself a victim of the collateral damage from the Curve hack. As USDC borrow rates on Aave increased to over 60%, traders on Voltz’ three Aave USDC pools were liquidated at abnormal levels, due to the extremely thin liquidity in the pools.

These insolvencies are the latest additions to the long list of issues associated with vAMMs. You can make the case that the vAMM was not directly at fault here, but it puts a high degree of pressure on the risk engine. vAMMs have proven time and time again that they are the most fragile of design mechanisms in DeFi. At this point, users should proceed with extreme caution when interacting with any vAMM.

The past few months haven’t been all bad for Voltz. They shipped USDC-SOFR rates on Avalanche, which is an underrated accomplishment for DeFi. A limited version of Voltz v2 is live on testnet, which will see the projects scope broadened to a generalizable derivatives margin engine.

It is worth noting that several v2 safety features would have prevented the previous insolvencies:

- Minimum and maximum bounds on LP ranges to remove quotes at outrageous prices

- v2 uses a TWAP of the fixed rate, making it immune to sudden spikes

- Improved liquidation mechanics

This does beg the question why these features weren’t implemented in v1 (at least bullet #1).

Voltz has made it through a rough summer and hopes to redeem itself with a successful pseudo-pivot to derivatives clearing house with its v2. The IRS vAMM momentum has dropped off significantly, and DeFi as a whole is fighting an uphill battle for product market fit in interest rate derivatives.