Tomorrow, September 30, 2025, zkVerify is launching its mainnet and native token VFY. On the consulting side, we’ve covered zkVerify for the better part of the past year.

Our thesis is simple. ZK is eating infra and apps but verifying proofs on Ethereum is still broken. It’s inefficient, slow, and expensive. For devs, integrating ZK verification flows remain a pain in the ass. The EVM lacks universal precompiles, and fee markets treat ZK proofs (ZKPs) like luxury goods. The result? Millions in gas wasted by ZK rollups and zkApps who are forced to play along.

zkVerify in a Nutshell

zkVerify tackles these issues at the protocol level. It is positioned as a unified verification layer that optimizes ZK proof verification at scale. As a modular L1, zkVerify strips away the complexity from the ZK stack. Devs no longer need to maintain circuit-specific contracts nor have to deploy a verifier. And by retaining dedicated block space for ZKPs, the protocol is able to scale ZK verification while cutting proving costs drastically.

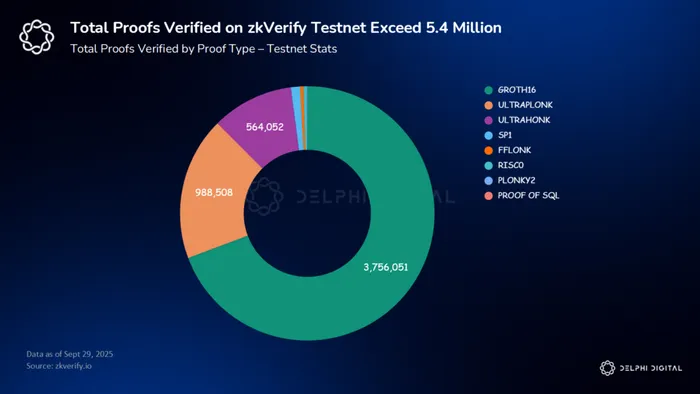

No more unanswered prayers for Ethereum to add precompiles for your proof system. zkVerify supports all major proof types: Groth16, Ultraplonk, Ultrahonk, SP1, Fflonk, Risc0, Plonky2, and Proof of SQL. And zkVerify allows you to prove once and verify anywhere.

While meaningful mainnet traction is not guaranteed, zkVerify has fostered over 400,000 testnet participants and verified over 5,400,000 proofs on testnet.

The Opportunity

Beyond optimizing ZK verification for ZK rollups, ZKPs can be leveraged across a wide range of use cases. From verifiable AI, digital ID, and privacy to zkTLS and provable gaming, ZKPs open up the design space across many sectors.

To no surprise, the consensus is that the proving market will continue to grow meaningfully.

VFY – Tokenomics & Unlock Schedule

VFY, zkVerify’s native token, will be the first ZK verification token coming to market. At TGE tomorrow, the following exchanges will support day one trading :

- Binance Alpha & Binance Futures

- Kucoin

- Gate

- MEXC

- Bitget

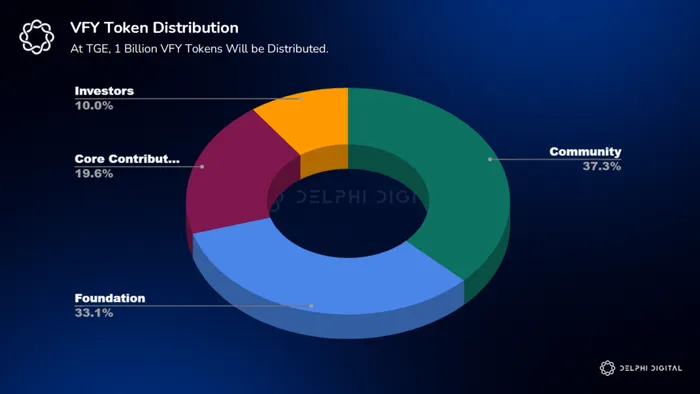

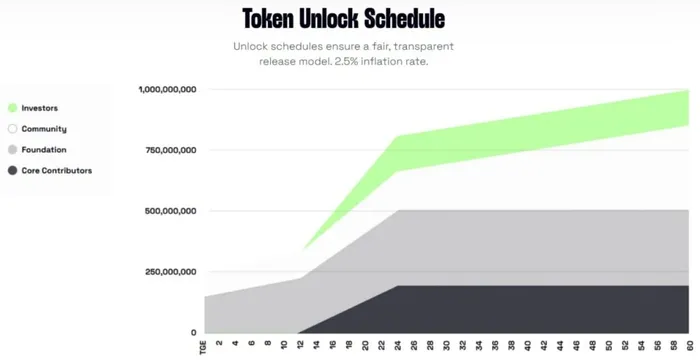

VFY will have a token supply of 1 Billion with a 2.5% inflation rate. Distribution, vesting, and the release schedule are as follows:

- Community

- Allocation: 373,064,875 tokens (37.31%)

- Vesting: 29% unlocked at TGE, remaining portion unlocks monthly over 48 months beginning at 12 months

- Investors

- Allocation: 100,000,000 token (10%)

- Vesting: 0% unlocked at TGE, Monthly over 12 months beginning at 12 months

- Foundation

-

- Allocation: 330,635,125 (33.06%)

- Vesting: 60% unlocked at TGE, remaining portion unlocks monthly over 24 months beginning at TGE

- Core Contributors

- Allocation: 196,300,000 (19.63%)

- Vesting: 0% unlocked at TGE, Monthly over 12 months beginning at 12 months

Check out our previous coverage if you want to read up on zkVerify’s infra, integration flow, use cases, and VFY’s token utility:

- Deep Dive, “zkVerify: Optimizing ZK Proof Verification At Scale”

- Memo focused on token economics, integration flow, and potential markets

- Memo covering use cases, value proposition, and zkVerify’s strategic positioning

Proof verification as it exists today cannot scale alone. Every new proving system forces developers to reinvent the wheel. Rollups have to ration proof submissions and zkApps are bogged down by circuit-specific integration debt.

zkVerify breaks this loop. It cuts cost, lowers latency, and kills system complexity – without locking protocols into one proving system or base layer. So there is the case to be made that zkVerify presents a scalable path forward. If zkVerify becomes the connective tissue that enables scalable, efficient verification for a plethora of use cases, then the VFY token is worth keeping on one’s radar.