Prioritize recent content

Top Results117 results

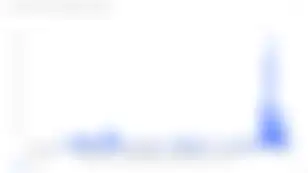

Users lock up CRV in Curve governance and receive vote-escrowed CRV (veCRV) in return....At launch the CVX/CRV mint ratio was ~450....the % of CRV daily emissions it captures....As mentioned previously, Convex is earning ~73% of CRV emissions.

Report

9 Min

AMM

Aug 2021

Gaming CRV Farming

While Twitter goes crazy over penguin NFTs, there have been a few things in DeFi...month-old) protocol, Convex Finance has achieved a new milestone by officially flipping Yearn in terms of CRV...The imminent 15% reduction in CRV emissions this month could also serve as a catalyst as the battle for...CRV emissions intensifies.

Report

4 Min

DeFi

Aug 2021

📊 Fraxlend Attracts $10M in Collateral as a Whale Deposits CRV

Fraxlend is an over-collateralized...The growth can be traced to three transactions by 0x7a…5428 in the CRV money market....The address collateralized 10M CRV tokens to borrow 3.5M FRAX tokens. ...The CRV money market has reached a utilization rate of 90%.

Report

4 Min

Money Markets

Oct 2022

But I find the latest Aave vote to purchase CRV a little disquieting....However, the CRV collateral far outstripped the available liquidity for CRV....However, there is still little CRV liquidity and many CRV collateralized loans....There are rumors of CRV OTC deals and ‘off-chain communication.’...

Alpha Insight

3 Min

DAO

Aug 2023

...and the liquidity of CRV....CRV Liquidity:

With such large positions at risk, they pose serious concerns to the CRV price considering...CRV/ETH Curve Pool Hack:

Yesterday, several Curve pools were exploited, including the CRV/ETH pool....This removed a significant amount of CRV liquidity....He has also seeded this pool with 100k of CRV rewards.

Alpha Insight

4 Min

DeFi

Jul 2023

An increase in veCRV% is a bullish long-term indicator for CRV....liquidity in the form of newly issued CRV....CRV depositors earn higher total yields via CVX rewards allowing it to divert 10% of the CRV rewards...surpass the rate at which CRV is being released into the market? ...both CRV issuance and all vesting supply.

Report

4 Min

Vaults

Jun 2021

Convex Finance Owns Largest Piece of CRV Pie

Convex Finance continues to dominate the Curve wars as...The political power of being a CRV “whale” is extremely valuable, as it allows for Convex to boost Curve...rewards for Convex’s depositors instead of having individual depositors lock up their own CRV to boost...through owning CVX, instead of locking up CRV.

Report

3 Min

Vaults

Nov 2021

The CRV token launched in Aug. 2020 with an incredibly small float and rapid emissions, causing its price...At the time, CRV’s token economics were heavily criticized, but they’ve since proven their token model...LPs on Curve get a boosted yield by locking CRV tokens into veCRV....It’s worth noting that the majority of the newly emitted CRV is locked within Convex.

Report

3 Min

Vaults

Oct 2021

Firstly, ~633K CRV are being emitted every day to Curve LPs....maintaining its peg to CRV, as well as being able to attract more CRV deposits than regular veCRV....Secondly, ~16% CRV APR, which is generated by paying 10% of all CRV farmed on Convex to cvxCRV holders...The 10% fee paid to cvxCRV stakers is then 10 CRV and 6 CVX.

Report

17 Min

AMM

Feb 2022

As of writing, Curve has locked ~89M CRV and minted ~93M CRV since September 19th (admin fee switch date...While minted CRV outpaces locked CRV, the locking rate seems healthy....And yet, CRV locks are almost at par with mints....The principal capital committed to locking CRV is made up for in CRV yield over some period of time.

Report

7 Min

DeFi

Feb 2021

The CRV token is also being offered as a bonus in the sUSD pool....CRV Token

Curve released a draft of its proposed governance and value accrual token, CRV, which will...Initially there will be 1B CRV tokens, with a hard cap of 3.03B....and burn CRV in the future.

Report

6 Min

DeFi

Jul 2020

Simply put, Curve’s stablecoin AMM rewards its liquidity providers with CRV, which can be 1) sold to...realize yield or 2) staked into veCRV (voting escrowed CRV), where a weekly vote decides how rewards...This gives them the most governance power to decide where CRV incentives should be distributed....CVX and CRV justly fit under their mandate.

Report

5 Min

Vaults

Jan 2022

...veCRV, vlCVX, cvxCRV, and cvxFXS

To summarize:

veCRV = Vote Escrowed CRV (max lock of 4 years)

vlCVX...protocol, monitoring the accumulation of veCRV and significant unlocks will often bring insight into CRV...In the first week of July, the rate of locked CRV saw a significant increase – as did the price of CRV...

Report

9 Min

Spot Exchange

Jul 2022

This model allows CRV holders to lock up their tokens as vote-escrowed CRV (veCRV) for up to 4 years....The longer a user locks their CRV for, the more veCRV they receive....Boosted CRV rewards on liquidity provider positions (up to 2.5x)....Lock part or all of the CRV they receive as rewards for providing liquidity.

Report

8 Min

Money Markets

Apr 2022

When it’s time to withdraw, users can choose from cxvCRV, CRV, CVX or ETH....Yields from those vaults are harvested, swapped into CRV and then staked on behalf of the farmer in the...Convex CRV vault where they auto-compound....Users may withdraw any or all of their deposits and yield at any time in cvxCRV, CRV, CVX or ETH.

Report

7 Min

Structured Products

Jul 2022

CRV to cvxCRV, a liquid version of the 4-year locked veCRV....Fees are split accordingly:

CRV:

10% goes to cvxCRV stakers paid in CRV

5% goes to CVX stakers, including...CVX emissions are scaled down on every 100k CRV earned....To achieve the maximum boost and veCRV, one has to lock up CRV for 4 years.

Report

10 Min

Vaults

Feb 2023

...where the Frax protocol stakes its Curve LP tokens, makes up the majority of the Curve AMO, followed by CRV...Their ownership makes up 54% of the FBP, allowing them to farm CRV and CVX emissions on Convex with this...FRAX into the FBP to balance this new demand, it results in Frax earning more fees and rewards from CRV...

Report

11 Min

Algorithmic Stablecoins

Feb 2023

FRAX, MIM and alUSD currently account for more than 50% of Convex gauge vote and most of Convex CRV rewards...Against Argument: The opposition in the thread suggests that Aave’s treasury should be used to accumulate CRV...In the oppositions estimation the community is more interested in accumulating CRV tokens over BAL and...CRV.

Report

6 Min

DAO

Sep 2021

This model allows CRV holders to lock up their tokens as vote-escrowed CRV (veCRV) for up to 4 years....The longer a user locks their CRV for, the more veCRV they receive....Boosted CRV rewards on liquidity provider positions (up to 2.5x)....Despite such an imbalance, cvxCRV is only trading at a ~2% discount against CRV for a 1M CRV trade.

Report

21 Min

AMM

Apr 2022

CRV is on an absolute tear today, but other top DeFi tokens are in the green as well....Blue chips like CRV, SNX, AAVE, and COMP are leading the bounce, followed by derivative protocol tokens...

Report

4 Min

Infrastructure

Sep 2021