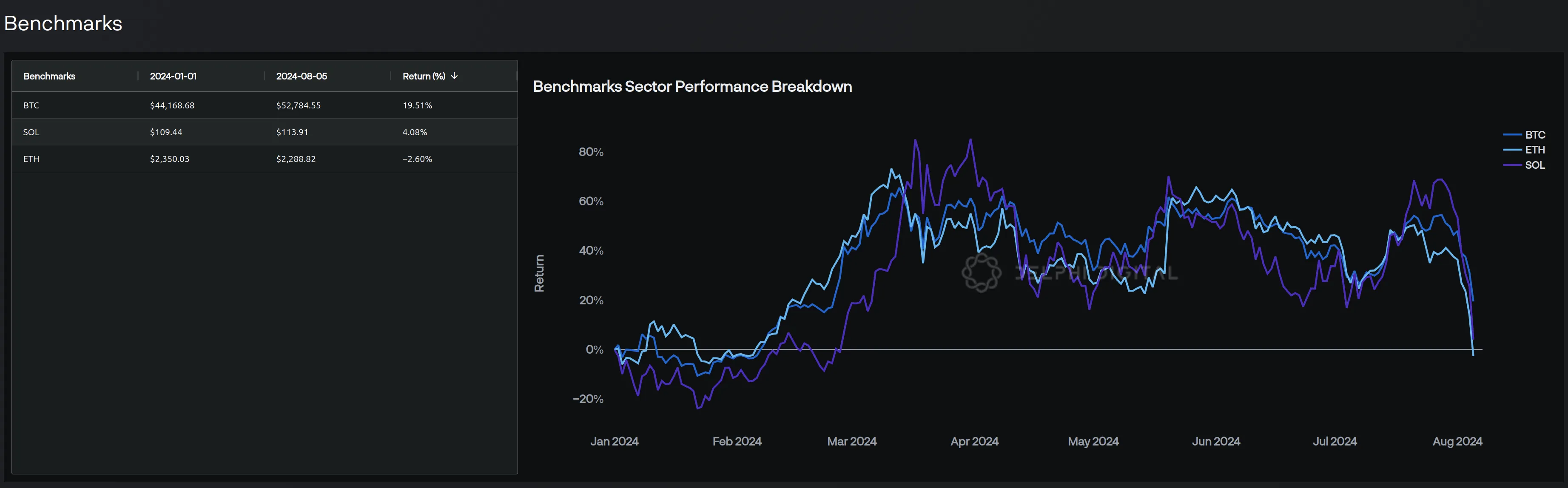

Given the overnight move in the Majors, ETH is now negative on a year-to-date basis (-2.6% as of 3:00 AM EDT), while SOL is not far behind (+4.1%).

More broadly, 10 out of 13 assets within our L1 basket now have negative returns on a YTD basis.

It’s important to zoom out during these times, and remember that events like these can be com

...